Global Mobility Tax Compliance: A Practical Risk Guide for Remote Workforces

Remote work has fundamentally changed how—and where—employees perform their jobs. While flexibility has increased, so has exposure to global mobility tax compliance risk.

Key Takeaways

- Global mobility tax compliance risks can arise quickly from cross-border remote work.

- Risk is driven primarily by time spent abroad and employee activity level.

- Payroll misalignment often increases exposure.

- A risk-based approach helps employers focus attention where it matters most.

What Is Global Mobility Tax Compliance?

Global mobility tax compliance refers to an employer’s responsibility to manage tax-related obligations when employees perform work outside their home country.

These obligations can include:

- Employee income tax withholding and reporting

- Employer payroll taxes and social security contributions

- Tax residency considerations

- Permanent establishment (PE) risk

- Alignment between tax, payroll, and immigration status

In a remote-work environment, these issues can arise without a formal assignment, often before organizations realize exposure exists.

Many employers support compliance by providing employees with coordinated home and host country tax briefings. CapRelo’s home and host tax briefing coordination services help employees understand tax obligations and reduce surprises when working across borders.

Why Remote Work Creates Hidden Tax Risk

Remote work often lacks the approvals, tracking, and structure found in traditional mobility programs. As a result, even informal or short-term cross-border work can create global mobility tax compliance risk.

Extended or repeated stays, payroll misalignment, and revenue-generating or decision-making activities abroad can quickly increase exposure, especially since enforcement thresholds vary by country.

A Risk-Based Way to Think About Global Mobility Tax Compliance

Rather than viewing compliance as a binary “compliant vs. non-compliant” issue, many organizations adopt a risk-based framework.

At a high level, global mobility tax compliance risk is commonly influenced by two primary factors:

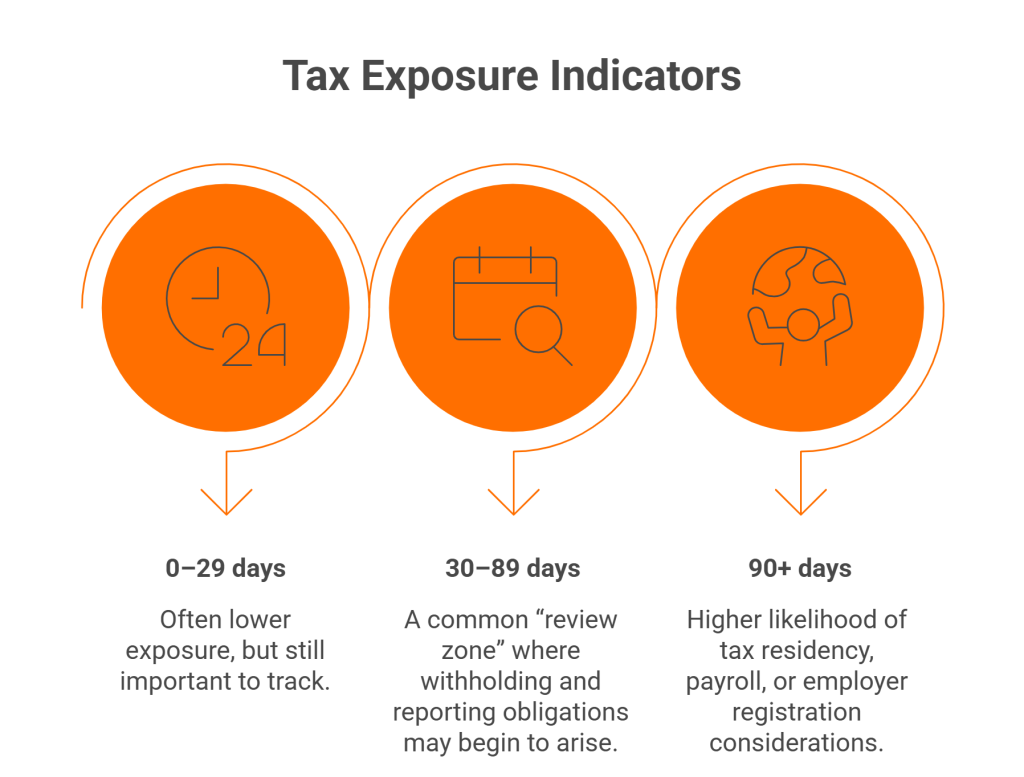

- Duration of Work Outside the Home Country

The number of days an employee works abroad is one of the most consistent indicators of potential tax exposure.

Tracking duration helps organizations identify when informal arrangements begin to cross compliance thresholds.

Common Global Mobility Tax Compliance Scenarios

Why Payroll Alignment Matters

Payroll mismatch occurs when an employee is paid in one country while performing work in another. This misalignment can complicate income tax withholding, increase employer reporting obligations, and create exposure to retroactive corrections or penalties.

Even when overall risk appears moderate, payroll misalignment often signals the need for closer review.

Building a Sustainable Global Mobility Tax Compliance Strategy

Organizations that manage remote and mobile work effectively focus on clear policies, defined approval thresholds, visibility into where work is performed, and early risk identification.

This proactive approach helps balance workforce flexibility with global mobility tax compliance.

Global Mobility Tax Compliance Risk Checker

Use this quick checker to estimate global mobility tax compliance risk for cross-border

remote work scenarios. This is a high-level indicator only and not tax advice.

How to Use This Page

Step 1: Confirm how long the employee is working outside their home country.

Step 2: Identify the nature of the employee’s activities while abroad.

Step 3: Consider where payroll is run compared to where work is performed.

Step 4: Use the risk checker to decide whether further review may be needed.

Disclaimer: This checker provides a high-level risk indicator only and does not constitute

tax or legal advice. Requirements vary by jurisdiction and depend on specific facts and circumstances.

Global Mobility Tax Compliance FAQs

What is global mobility tax compliance?

Global mobility tax compliance is the process of managing employer and employee tax obligations when work is

performed across international borders. It can involve income tax withholding, payroll reporting, social

contributions, and corporate tax exposure depending on the facts and jurisdiction.

Can remote work across borders trigger global mobility tax compliance requirements?

Yes. Cross-border remote work may trigger tax and payroll obligations based on factors like time spent in-country,

where payroll is run, and what activities the employee performs. Requirements vary widely by jurisdiction.

How many days can an employee work abroad before tax obligations may apply?

There is no universal threshold. Some jurisdictions may require action after relatively short stays, while others

use longer residency-style thresholds or activity-based rules. Tracking days worked abroad is a common first step

in managing risk.

What is permanent establishment (PE) risk and why does it matter?

Permanent establishment risk refers to the possibility that an employee’s activities create a taxable corporate

presence in another country. Activities such as revenue generation, contract negotiation, or executive

decision-making can increase PE risk depending on local rules and circumstances.

Why does payroll location matter for cross-border remote work?

If payroll remains in the home country while work is performed elsewhere, it can increase withholding, reporting,

and employer registration complexity. Payroll alignment is a common indicator used to flag scenarios for further

review.

Is the CapRelo risk checker tax advice?

No. The checker provides a high-level risk indicator only and does not constitute tax or legal advice. It is designed

to help teams identify when a scenario may warrant a deeper compliance review.

How can CapRelo help with global mobility tax compliance?

CapRelo helps employers identify cross-border remote work risk early, strengthen policy and approval workflows,

improve visibility into where work is performed, and coordinate tax, payroll, and immigration considerations.

Disclaimer: This content is for informational purposes only and does not constitute tax or legal advice.

Requirements vary by jurisdiction and depend on specific facts and circumstances.